No matter the uncertainty, plan we must

"The level of uncertainty in this index is higher than even when it was during the Great Depression, during the great financial crisis and during COVID. That speaks to the level of uncertainty." - Economist Martin Lavelle, Federal Reserve Bank of Chicago

“Consumer confidence in the stock market is at euphoric levels, higher than during the dot-com bubble of 2000. Yet consumer sentiment about their own economic future is at literally Great Financial Crisis levels. This has never happened before in modern economic history. The gap between these two measures is screaming that something is about to break.” - Blockchain News

It’s so easy to just keep going on down the road well travelled, taking the usual path, sailing the course we charted a long while ago. It feels right, it’s what we know, it’s what we have optimized for. This sense of “right course” is a big reason why people and organizations tend not to plan for change.

Yet I can look at my sports for evidence that just “keeping on” is often not the best approach: Sailors know that wind, weather, and tide bring constant change that must be accounted for, skiers know that current snow conditions likely will not last and call for monitoring and adaptation, and triathletes recognize that three simple sports - swimming, biking, and running - when combined present not just a challenging tableau but a shifting calculus of what the best strategy is at any point in the race.

We strategists know that good plans, plans that will bring better results when implemented, are built on a set of assumptions about the future. The question is, how to discern that future so our planning assumptions better fit how that future plays out.

“Ze markets, zay will vary!”

I am not an economist. But I am highly attuned to the economy and especially changes in it, to signs and signals. My heightened awareness of the economy started with what I learned from my economics professors at the University of Chicago Booth School. (I have an awesome memory of craggy old Professor Victor Zarnowitz, an international expert in the business cycle who during World War II fled Poland to escape the Nazi invasion, was imprisoned by the Soviet Russians and worked at a labor camp in Siberia, and thereafter earned his Ph.D. in economics (summa cum laude) at the University of Heidelberg. Standing before our class of MBA students, Professor Zarnowitz asserted sternly in his heavily accented English, “Ze markets, zay will vary!” I did not realize at the time that he was the first to identify the historical pattern in which deep recessions are usually followed by steep recoveries, which is now known by economists as "the Zarnowitz rule," nor did I know that for years he was one of the six economists who decided officially that the U.S. was in a recession.)

I learned more about the economy over the decade and a half that I worked as a bank trade association executive, commercial banker, and financial journalist, in subsequent years leading organizations and being an entrepreneur, and, continuing to this day, in my work as a strategy consultant and a business coach.

Stopped in my tracks

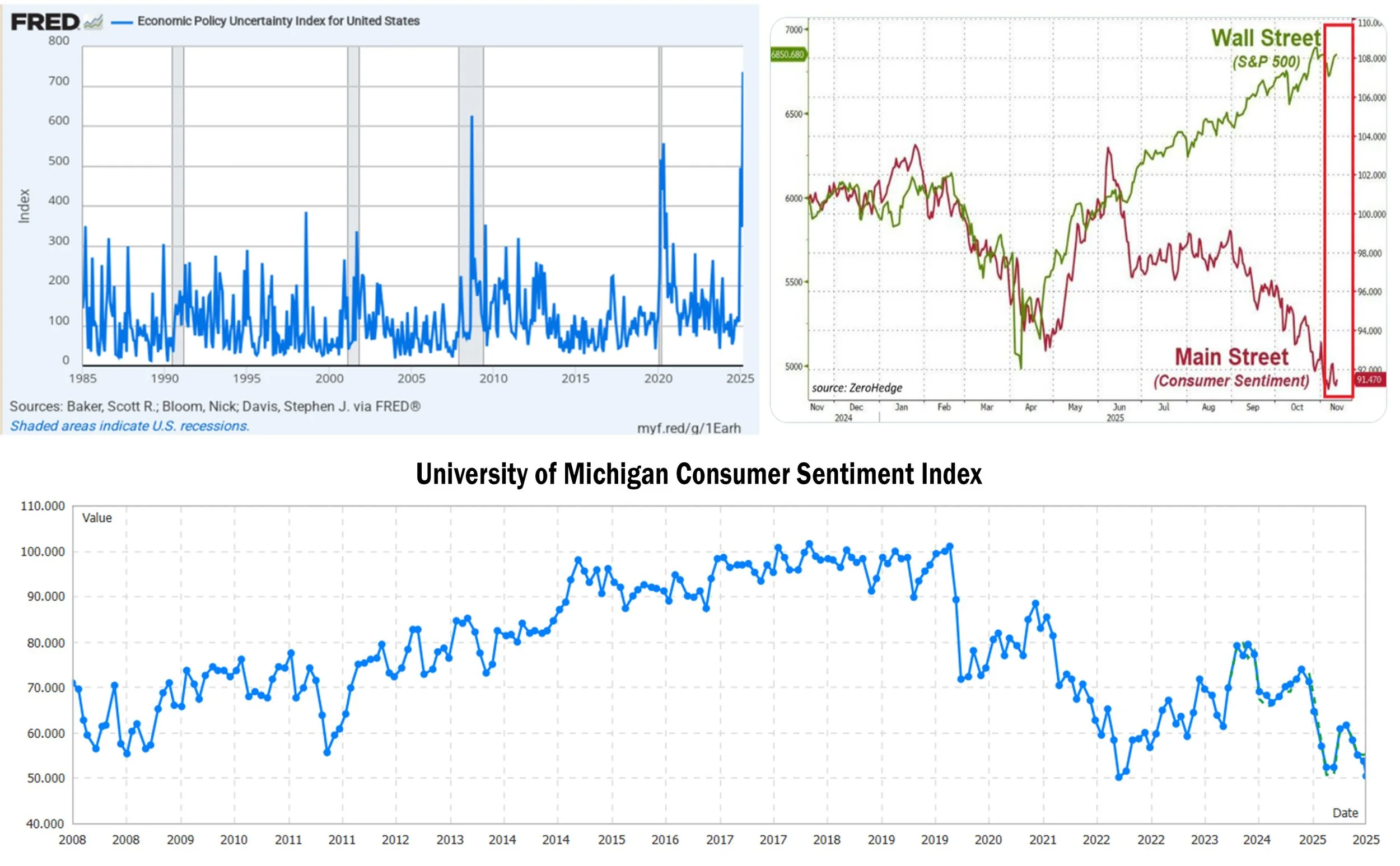

It was what I knew about macro economics from my schooling and experience that stopped me in my tracks when economist Daraius Irani of Towson University displayed a chart in a recent presentation on the state of the U.S. economy. Dr. Irani showed us the historical trend of the so-called economic policy uncertainty index, which he said now was at record highs, surpassing where it stood after 9/11, in the 2009 recession, and even during the COVID 19 Pandemic. (See the chart at the upper left.)

After that revelation, I started connecting the dots. Digging deeper, it became clear that not only is uncertainty off the rails, but consumer confidence is at record low levels. (See the lower chart in the display above.) Yet, despite the great uncertainty and low confidence, stock market indexes have been breaking records. (See the chart at the upper right.)

In the CEO Roundtable that I chair, last week we discussed the level of uncertainty and what it meant for our businesses. For some, business has been slow, especially earlier in the year. Others were not seeing much impact. The unanswerable question, at least now, is how these trends will play out and interact going forward. Are we on the precipice of a big recession? Or are the causes of the uncertainty and low sentiment transitory, such as fluctuating tariffs and the government shutdown?

What we can do

Humorist Will Rogers said, "Even if you are on the right track, you'll get run over if you just sit there." Whether or not we have a suspicion or even a forecast of how things are going to play out, just keeping on with business as usual is not recommended. It’s true that effective planning in highly uncertain times is much harder than planning in more normal times. But I contend that it is more important than ever to plan in times of high uncertainty. In normal times, keeping on in the same direction that is already working carries less risk than just keeping on when the environment is poised to change dramatically.

Planning as a hedge against uncertainty

The paradox of planning in uncertain times is this: The less predictable the future becomes, the more valuable the planning process becomes - not less. When business strategy firm Oliver Wyman surveyed CEOs earlier this year, they found that executives were dedicating 43% of their planning efforts to time horizons of less than one year. In such uncertain times this short-term focus is understandable but potentially dangerous. It's like driving faster while looking only at the road immediately in front of your hood rather than keeping your eye on what’s further down the road, good or threatening.

What's needed now is a planning approach that acknowledges uncertainty rather than pretends it doesn't exist. This means moving beyond the traditional single-scenario plan ("here's what we think will happen") to a multiple scenario approach. ("Here are the multiple futures that could unfold, and here's how we'll succeed in each").

Foundational step: the Environmental Scan

A major part of the foundation for effective planning in uncertain times is a rigorous Environmental Scan - a systematic look at the external forces that could reshape your organization’s future.

As I conduct it, the Environmental Scan examines six categories of external forces, a version of what we strategists call a PESTLE analysis:

Economic factors: Interest rates, inflation, consumer spending patterns, labor markets

Political and legal factors: Regulatory changes, trade policy, government stability

Social and demographic trends: Population shifts, lifestyle changes, cultural movements

Technological trends: AI adoption, automation, digital transformation

Market and industry dynamics: Competitor moves, customer expectations, supply chains

Environmental factors: Climate impacts, sustainability requirements, resource availability

As you identify trends in each category, you tag those that you think ought to be considered as you shape your plan as Opportunities (favorable trends you can exploit) or Threats (challenges you must mitigate). This tagging helps you translate external trends into strategic priorities.

Beyond the basics: Scenario planning

When organizations face high uncertainty, it’s helpful to go beyond basic Environmental Scanning. The next level involves categorizing the identified trends on two critical dimensions: their importance to your organization and their predictability. This creates four distinct buckets:

Known Factors (Important & Predictable): These are certainties your strategy must address

Key Uncertainties (Important & Unpredictable): These become the basis for so-called scenario planning

Monitor Items (Less Important & Predictable): Less important, but keep an eye on these

Ignore (Less Important & Unpredictable): Don't waste planning bandwidth here

The most powerful trends are those in the "Important and Unpredictable" quadrant. These become the foundation for scenario planning—building multiple plausible futures rather than betting everything on a single anticipated future.

For example, looking at the charts above, two critical uncertainties might be: (1) Will consumer sentiment collapse into actual recession, or will it recover as policy uncertainty resolves? and (2) Will the stock market maintain its euphoric levels, or will it correct to align with Main Street reality?

These two somewhat independent but critical uncertainties can generate four distinct scenarios:

Scenario A: Sentiment recovers AND markets stay strong (soft landing achieved)

Scenario B: Sentiment recovers BUT markets correct (healthy reset)

Scenario C: Sentiment collapses BUT markets stay elevated (greater divergence)

Scenario D: Sentiment collapses AND markets correct (recession)

Each scenario demands different strategic responses. But more importantly, this approach helps you identify "no-regret moves"—strategies that will strengthen your business regardless of which future unfolds. In our example, these might include building cash reserves, strengthening customer relationships, investing in operational efficiency, or developing new capabilities that create value in multiple scenarios.

Whistling past the graveyard?

Again, the unanswerable question is: Are we on the precipice of a major recession, or are these disruptions transitory? The honest answer is that no one knows. Not the Federal Reserve, not the forecasters, not even the eight economists on the NBER Business Cycle Dating Committee who officially declare recessions.

But here's what we do know: The organizations that emerge strongest from uncertain periods are rarely those that made the perfect prediction. They're usually the ones that prepared for multiple outcomes, maintained strategic flexibility, and kept moving forward with purpose rather than freezing in place.

Professor Zarnowitz taught me that markets will vary. Today's unprecedented uncertainty proves him right once again. The question for every business leader is not whether the future is uncertain - it clearly is - but whether you'll use that uncertainty as an excuse for inaction, in essence, “whistling past the graveyard,” or as a catalyst for rigorous strategic planning that looks at and build strategies based on key trends, ideally by using scenario-based planning.

The solution isn't to stop planning because the future is unclear. It's to plan differently - with humility about what we can't predict and discipline in preparing for multiple possibilities.

Environmental scanning with FastTrack™

Our new strategic planning web app, FastTrack™ (www.FastTrackPlanning.com), guides users through an Environmental Scan, with identification of significant trends that are then tagged as opportunities and threats that merit consideration when setting strategies.

To provide deeper strategic foresight to help organizations navigate uncertainty, we are enhancing FastTrack™ to enable categorization of trends by importance and predictability, and are introducing a process for creating scenarios that lay out multiple plausible futures. Addressing a range of possibilities will result in a more robust and adaptable plan—one that’s more likely to succeed no matter which future unfolds.